How To Register An Overseas Business In The Us

If you're building your business for a better life similar I am, chances are you want that concern to be:

- cheap to operate,

- piece of cake to manage,

- profitable, and

- without friction (both for you and your clients/customers).

Business isn't like shooting fish in a barrel, but it doesn't accept to be hard.

Equally an Australian who has lived in multiple countries and done concern with companies all around the globe, I've learned a lot most making business unnecessarily difficult.

If y'all await at that list above, I've found myself heedlessly operating my businesses through entities that are:

- expensive to operate,

- unbelievably difficult to manage,

- get unprofitable fast after paying agents to fix your bug, and

- have friction at every step, from paying suppliers to integrations to getting paid by clients and customers.

I'd ever told myself it was worth it for a myriad of reasons (though mostly just the result of being curious and wanting to accept "tried information technology once"). Information technology rarely was.

Despite beingness a foreigner, opening a company in America may be the all-time business determination I've made to engagement. While it won't solve your business problems, information technology won't cause y'all a heap of new bug. Everything is just… easy!

If you're a non-denizen, not-resident greenhorn and yous want to register a company in the USA, this article is for you.

Tin can a Foreigner Commencement a Business organisation in USA?

Yes, absolutely. This is equally relevant for multi-national brands as it is for solopreneurs. Though the exact percentage is hard to pinpoint, there are plenty of strange-endemic US companies doing concern in both America and abroad.

In that location are a few actress hoops to jump through equally a greenhorn, but as you lot'll see beneath, they aren't peculiarly onerous.

The exception here is that y'all cannot form an S-Corp without US resident shareholders, but as yous will too see below, that's not a problem for nearly of us.

Why Exercise Foreigners Want to Commencement a Business in USA?

Later writing about the best place to incorporate an online business, I've spoken with people of all walks of life who, for 1 reason or another, cannot run their online business in their home land.

Below yous'll run into some of the common reasons people cite for deciding to starting time a company in the United states of america vs their home country.

Banking

Low price, government-backed bank accounts that operate in a stable currency with quick transfers to basically anywhere. US banking isn't perfect, merely there's plenty to like.

Most digital cyberbanking products operate out of the Us, forth with rewards credit cards if you desire to go down that track.

Fees

When you're from a state where it's very cheap and easy to form a company, you probably don't give this much thought. In some countries, information technology can price thousands in authorities, legal, notary, and other fees to starting time a new company, besides as annual renewal fees and whatsoever fourth dimension you decide to brand changes to that visitor.

An example of this is my friend who wanted to first a travel agency in Spain. The start-upwardly company would be required to pay a €140,000 fee to annals every bit a retail amanuensis, then make a €180,000 bond deposit. This is in add-on to all of the other registration fees, allow alone actually existence able to fund the kickoff up costs of the business!

America is like most kickoff world countries, where registration and renewal is very affordable.

Reputation

I was recently contacted by someone from Nigeria. He operates a digital bureau providing content to other businesses. While he provides a quality service, his country's rails record online has cost him more in lost sales than he'd like to think.

By trading through a Wyoming LLC (Express Liability Company), he now leverages the reputation and trust that comes with American business.

Payment Processing

Another contact is edifice a SaaS product with her development team in Nepal. They need cheap, reliable, like shooting fish in a barrel-to-integrate payment processing, which they accept trouble finding locally.

By trading through a United states company, they gain admission to Stripe, considered by many to exist the gold standard of payment processing.

Ease of Operating

Some countries crave visitor owners to spend a ridiculous amount of time filing paperwork. If you're living in a country where the native linguistic communication isn't English language, getting paperwork done in some other language can be a real hurting.

If you're a non-resident, non-denizen operating a US LLC in a state like Wyoming, yous're unlikely to spend more than a day or two each year thinking almost your bodily operating entity.

Though these operating requirements will change down to every individual state of affairs, in a simple scenario of running a disregarded-entity Wyoming LLC, almanac requirements will look something similar this:

- filing annual compliance written report

- renewal of registered amanuensis service

- filing Form 5472 with Grade 1120 encompass page

Depending on who you use every bit a registered agent this is likely handled entirely by them. Renewal of their service only involves paying their bill, which fifty-fifty if they are expensive is probably only $500, and will include that almanac report filing.

Forms 5472 and 1120 will crave some input from you, but it volition probably amount to 30 minutes the kickoff fourth dimension you do it with the help of your agent if you accept kept bookkeeping records during the year.

Taxes

If yous live in a country with low income tax similar many cyberspace entrepreneurs, registering a US LLC may be advantageous. When run equally a "overlooked entity" without whatever "Finer Connected Income", there's substantially no taxation at the company level. Instead, it must be paid at the personal level.

More legally allowable deductions may as well be a do good. Many people will run their company with limited profits, merely their company gives them a lot of benefits, lowering their tax burden.

Tax is circuitous, but many people choose to do business via a US LLC for these reasons.

Remember: there's no 1 size fits all rule when information technology comes to tax, so if you're planning to use a US LLC and do not fully understand the taxation implications, I can't stress enough just how of import it is to get professional advice.

Corporation vs LLC: Which is All-time for a Foreigner?

Similar other countries, in that location are a number of different means that you tin can trade equally a business in USA.

For example:

- C-Corp

- S-Corp

- Limited Liability Companies

- Partnerships

- Sole Proprietorships

More often than not, foreign citizens and companies contain their US business as an LLC or C-Corp. This is considering neither of these types of entities has restrictions on the number of strange owners.

Partnerships and Sole Proprietorships are not pop as they do not limit the owners from liability in the aforementioned way that a C-Corp or an LLC does.

If y'all are a solopreneur or a small business organization owner, an LLC is probably the best fit. They are by far the most common choice among foreign small business concern owners wanting to establish their concern in the Us.

The exception to this dominion is if you are planning to seek investment capital. C-Corporations formed in Delaware are a particularly popular choice amidst startups seeking venture upper-case letter.

Since I by and large write about lifestyle businesses that online business models can offering, from here on out I'm making the assumption that yous want to ready up a US LLC.

Which Land Is Best to Register an LLC for an Online Concern?

I won't get into the nitty gritty of this, as opinions and biases come up into play here. Generally however, y'all'll find 2 states to be the most common when information technology comes to registering online businesses:

- Delaware

- Wyoming

I'm going to massively oversimplify this for the sake of brevity, but they both:

- are inexpensive to operate out of,

- accept no income taxation (if non doing business in the state it is registered in), and

- have no sales tax (if not doing concern in the same state).

Delaware: For When Investors Are Involved

If you're taking investment capital from other parties, chances are that Delaware will be the best place to start. Your investors will probably have experience with this land already, and they will likely guide yous to it.

This is essentially due to the legal system in Delaware. Delaware's laws are very business-friendly, and the court is known to exist quick in reaching decisions. Due to the number of cases handled, there exists a large trunk of precedent, meaning fewer unknowns for LLC members.

Though at that place is no income tax in Delaware, there is a "franchise taxation" of $300 per yr (apartment fee).

Wyoming: For Small Partnerships and Unmarried Members

If you are doing it alone or with only a few others, Wyoming is likely a better bet. Wyoming comes with most of the benefits of Delaware, but:

- is cheaper to ready,

- is cheaper to renew,

- involves less paperwork and

- provides greater privacy.

Simplified further, Wyoming is cheaper and easier to register and operate. In the process below, I'll walk you through the steps for setting upwardly a Wyoming LLC.

How to Commencement a Company in USA equally a Greenhorn

Dear reader, time is your nearly precious resources.

Setting upward a new company might experience similar a major chore but it actually isn't.

My goal is for you to go ready and making money ASAP. I don't want you spendingwasting months and months thinking about getting started.

As a foreigner, the process isn't lightning fast. The showtime time you ready a United states of america LLC, the entire procedure can take around five weeks.

Equally you'll see though, a lot of this time is spent waiting around for other parties. Y'all shouldn't demand to spend more than than a twenty-four hours worth of your time in total on this process.

Step i: Register Your LLC

To start the procedure you need to work with what is known as a "Registered Agent". This is essentially a company who will register your new LLC.

You pay your fee, requite your agent two-three different company names, provide some personal information (which they keep confidential) and details of your business.

Ordinarily your new LLC will be registered within 72 hours.

Action: brainstorm the registration process with a registered agent. I trust Freedom Surfer.

Cost: $319

Step ii: Get a Physical Business organisation Address

This might seem like putting the cart in front end of the horse but I like things to be organised. If yous don't accept 1 already, become yourself a business organization address in the United states of america.

Yous can get away with using your registered agent'south accost, but oftentimes these get flagged with banks and payment processors and cause trouble down the road. This is because tens of thousands of companies are all registered to the exact aforementioned address, and in some cases, PO boxes are used.

For this reason, I recommend using a real, physical street accost service. There's no dominion proverb that your Wyoming LLC needs to use a Wyoming street address, but if you lot want to enhance the fewest flags with banks, information technology does make sense to do then.

This street address tin exist used to collect mail which can be scanned or forwarded to you, which can come in handy later on on for any IRS paperwork or credit cards you want sent to you (every bit they will not be shipped overseas).

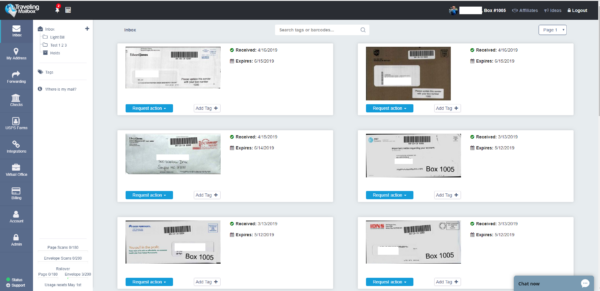

Action: sign upwardly for a physical street accost. I like Traveling Mailbox.

Cost: from $150/year

Step 3: Apply for an EIN

In gild to set up upward a bank account, you'll need an Employer Identification Number from the IRS. An EIN is essentially a social security or taxation file number, simply for business entities.

If yous have an SSN or an ITIN, you can utilize for 1 for complimentary online. If yous don't however, it tin be a fleck of a hassle to get i. You can practise so by:

- Fill up in Form SS-4.

- Fax it using a virtual fax service.

- Wait.

If you lot use a fax service you should receive a return fax within around four weeks of applying, otherwise, your virtual address service will open and scan this letter for you.

Many registered agents, like Freedom Surfer, volition provide an EIN application as office of their service.

Action: either file Form SS-4 yourself, or consult your registered agent.

Cost: from $0

Step four: Get a Banking concern Account

The days of needing to get on a plane to open up a bank account are long gone. Traditional banks are becoming increasingly difficult to work with, while newer "digital" banks are quick and easy to ready while having very few fees.

I'thousand bringing plenty of biases into this discussion, simply I feel the 2 best options are:

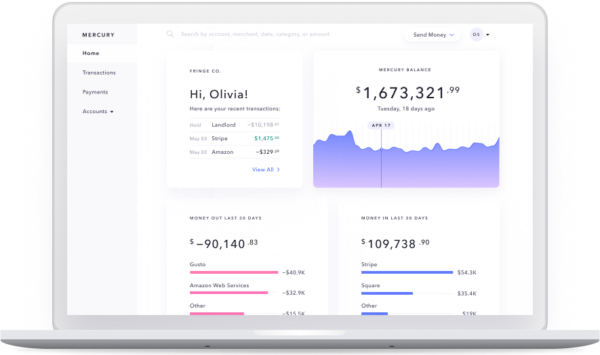

- Mercury: best for ecommerce, SaaS and service businesses, or

- Wise: all-time for affiliate marketing and content sites that earn advertising revenue.

Mercury provides you with many checking and savings accounts in USD, which is great if yous're planning on using something similar Profit First for your company. You also get physical and virtual debit cards on demand.

Wise on the other mitt, gives you local accounts in Australia, Europe, Singapore, USA, U.k. and elsewhere. This can be helpful if your business earns income from affiliate marketing and you need local bank accounts for program payouts.

Of grade, at that place's nothing stopping you from setting up both!

Action: apply for either a Mercury or Wise account.

Cost: gratis, with a $250 bonus at Mercury

Step 5: Go a Payment Processor

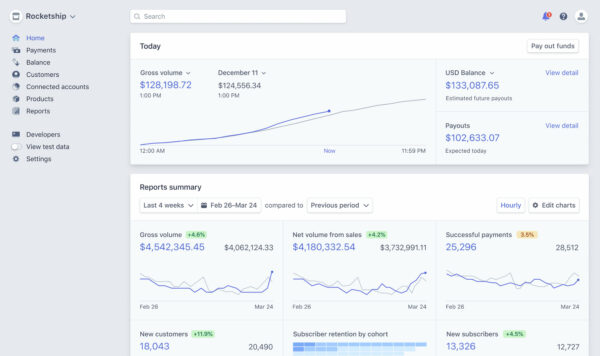

If you plan to procedure credit card payments, this stride is important. In general, your best options are:

- 2Checkout

- Stripe

Stripe requite a better rate, while 2Checkout permit you to process PayPal payments without a PayPal account.

These applications can require y'all to jump through some hoops. Depending on your level of paranoia and how ofttimes you travel, yous may want to set up a virtual desktop similar Amazon Workspaces to apply and login to these services.

Expect either payment processor to concord your payments for a longer period of fourth dimension in the starting time. They want to protect themselves in the upshot of chargebacks, and so try to have a few months' operating expenses in your banking concern account at the time of opening (and wait them to ask for a screenshot).

Action: apply for either a 2Checkout or Stripe account.

Cost: free

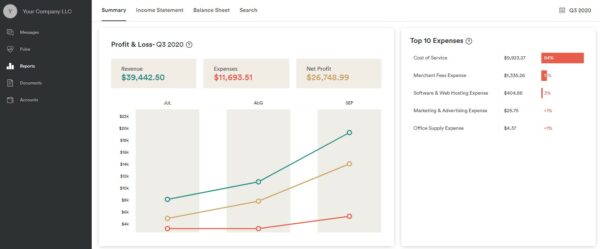

Pace 6: Prepare a Accounting System

At present that you're set up you lot'll want to brand sure you accept some sort of accounting system in identify, both for record-keeping purposes and to help y'all run your business organization well.

If y'all're planning on doing the accounting yourself, both Mercury and TransferWise accounts will machine-import into Xero daily. I do encourage you to not do this yourself though.

A service similar Bench can salve a lot of time, and information technology'south work you should really exist delegating. Yous get a company email address for receipts and just forward annihilation/everything to information technology, and everything is magically organised.

Action: sign up to a accounting service like Bench.

Cost: from $159/month

Fourth dimension to Trade!

In that location'due south no reason why you can't exist set and ready to do business with your new Usa company in around v weeks.

Non sure a U.s. LLC is right for you? Take a look at my guide to the best countries to register an online business organization, or if you lot're wanting something more than extensive, sign upward for this free low tax business prepare form run by my friend Kathleen.

If you observe the Liberty Surfer is non the correct registered agent for you lot, yous may also exist interested in these reviews of the most known LLC service providers.

As always, don't hesitate to leave me a comment! If I know the answer I'll exercise my best to betoken you lot in the correct direction.

Please notation: I tin can't answer any questions relating to visas. I have cipher experience in getting a green carte du jour or a different visa in the USA.

How To Register An Overseas Business In The Us,

Source: https://jaserodley.com/how-to-open-a-company-in-usa/

Posted by: gillhoch1980.blogspot.com

0 Response to "How To Register An Overseas Business In The Us"

Post a Comment